Company Valuation

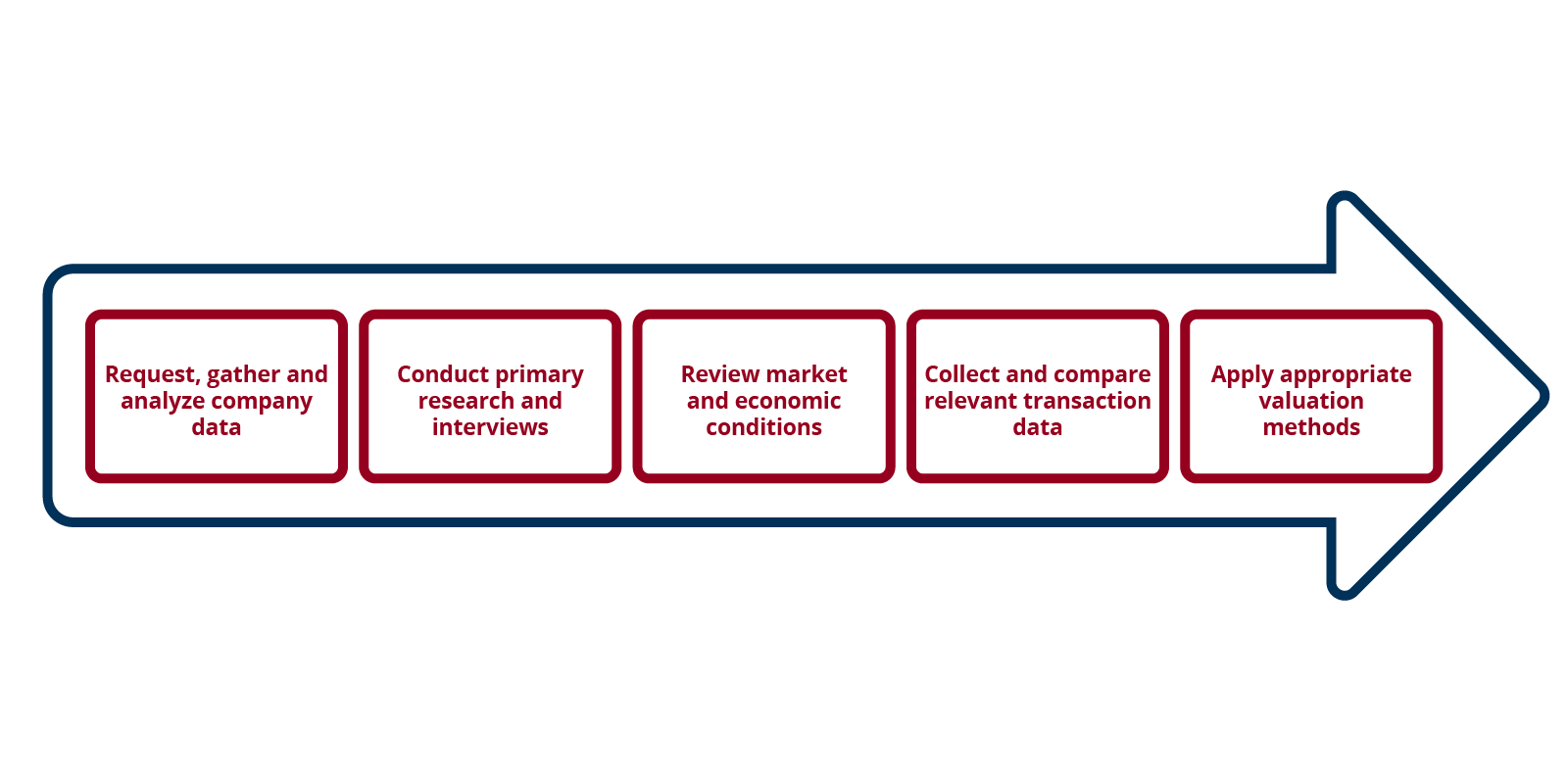

Using a multi-dimensional approach: we combine proprietary analytical tools with our deep experience of M&A transactions across a broad range of companies and industries.

Valuation is as much art as science, requiring the exercise of good judgment combined with a systematic analysis of the data. That’s why experience is such an essential ingredient of the process. There are many ways to calculate a company’s financial value, and none of them are perfect. All methods require trade-offs, which must be balanced with the strategic objectives driving the deal. Capstone’s solution is to adopt multiple perspectives, while exercising patient and thorough analysis to deliver reliable results.

Our valuation advisors bring over nineteen years of experience to the table and are well versed in sophisticated and complex valuation methodologies. Capstone’s services include valuation for acquisitions, divestitures, strategic planning and any circumstance where it is important to achieve a reliable measure of a company’s value.

Valuation Essentials

A brief summary of the principles that guide our valuation process:

- Valuation is inherently imprecise. Consider a range of values rather than a single “correct” value.

- Do not confuse value and price.

- Look to the future, not the past. History is relevant only as a partial guide to the future.

- Working backwards can be a valuable exercise. Ask yourself what you have to believe about a set of projections to justify a certain value.

- Valuation is more than a numbers game. You cannot appropriately value a company without a thorough understanding of the business and its environment.

- A company may have different values to different buyers because of the unique synergies the acquisition may offer in each case.

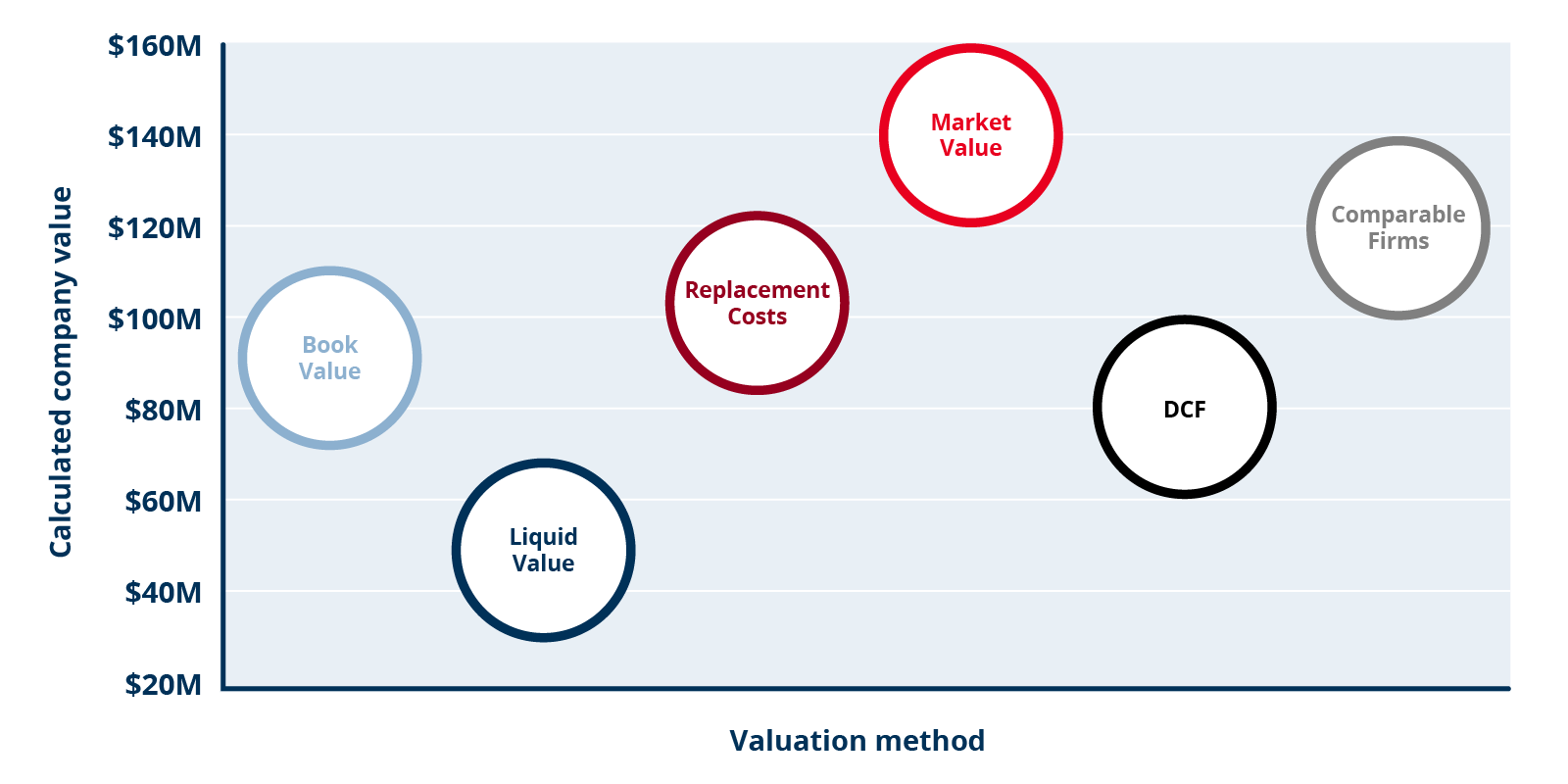

A Choice of Methods

There are many widely accepted techniques for arriving at a company valuation. At Capstone, we do not believe in one “right” method. We draw on all or any of these approaches in the combination that is most appropriate for the specific transaction:

- Discounted Cash Flow – Future cash flows discounted to present-day value

- Book Value – Cost of assets, less depreciation

- Capitalization Rate – NOI divided by price

- Liquidation Value – Amount for which an asset could be quickly sold or divested

- Replacement Cost – Amount of money to replace an asset

- Current Market Value – # of shares outstanding x current share price

- Market Comps – Trading values of similar companies

Different valuation methodologies result in calculating different values for the same company. The chart below illustrates an example of this concept (click for a larger view):

There is no one right method that is best suited for every situation. Understanding your goals and strategy is an important part of selecting the most appropriate valuation method.